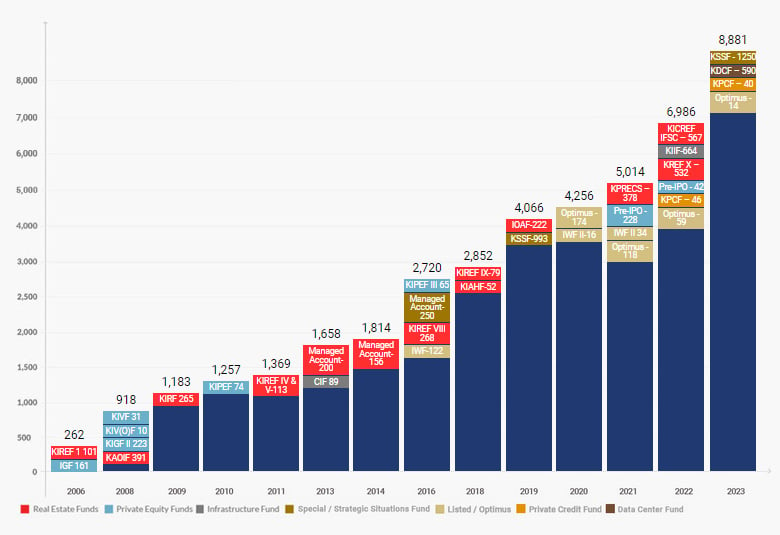

Funds Raised in Alternate

Assets

(USD million)

Our Alternate Assets business has successfully raised / advised / managed over USD 8.8 billion from a diverse set of domestic and international investors across multiple assets classes such as Real Estate, Private Equity, Special Situations, Infrastructure and Investment Advisory.